Legacies

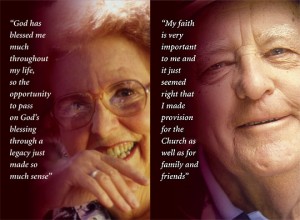

Please consider a gift to the Costa Blanca Anglican Chaplaincy through a legacy

Most of us, I am sure, do not like to dwell to much on thoughts of our own mortality. Yet for the Christian, it is essential that we should spend some time contemplating the journey of our life from its beginning to its end. Part of that process is practical as well as spiritual; there are family and friends for whom we might like to make some financial provision, to hand on valued possessions to those whom we love. Whilst we all make a valuable contribution to the Church during our lives it would also seem fitting that we should consider making some financial provision for the continuation of its mission after we have gone. I commend this scheme to you and earnestly request that you will consider making a legacy to help continue the work of the Costa Blanca Anglican Chaplaincy in the future.

Please remember that our chaplaincy is self supporting and its work is only possible because of the generosity of people like you – its worshippers. Should you wish to extend your generosity beyond the boundaries of life and arrange a legacy for the Costa Blanca Anglican Chaplaincy, we would suggest you use the following wording when making a U.K. will;

“ I give to the Diocese in Europe whose registered office is situated at

14,Tufton Street London SW1P 3QZ, the sum

of ………..Pounds to be applied for the mission

and extension of the Costa Blanca Anglican Chaplaincy and I

declare that a receipt from the Diocesan

secretary for the time being of the Diocese in

Europe will be sufficient receipt for my

executors for the same.

By using the foregoing wording you should ensure U.K. Inheritance Tax is not applied to your gift.

For those making a will in Spain the following wording, translated into Spanish by your lawyer, should be used;

“ I give to the Capellania Anglicana le la Costa Blanca, CIF # RO300395A, Domicilio Social, Buzon 3, Cometa 18, Senija, Benissa 03720, Alicante, and registered with the Federacion de Entidades Religiosas Evangelicas de Espana # 3226-SE/A, the sum of……………€ to be applied for the mission and extension of the Capellania Anglicana de la Costa Blanca and declare that a receipt from the treasurer for the time being of the Capellania Anglicana de le Costa Blanca will be sufficient for my executors for the same.

By using the foregoing wording you should ensure that Spanish Inheritance Tax is not applied to your gift.

If you have any questions or would like any help please contact our Treasurer Dennis Johnson on tresoroblanca@gmail.com or Telephone 686 499 060

Your gift will help future generations to worship and

carry out God’s mission here on the Costa Blanca.

Donations

Tax-Efficient Donations by UK Taxpayers

Although the Chaplaincy is not a registered UK charity, exemption from UK income tax is granted when donations are channelled through the Diocese in Europe. The tax which has been paid, on the giving of Church people, can be recovered from the Inland Revenue. Church people should understand that this recovery of tax is not “stealing from the Government” but good stewardship of their own resources.

Gift Aid

How does it work?

Gift Aid is surprisingly easy to use. it can apply to donations of any amount, large or small, cheque, postal order, direct debit, standing orders in Sterling or Euro.

If you are a UK taxpayer, all you have to do is give the Diocesan office, on behalf of the Costa Blanca Anglican Chaplaincy a simple Gift Aid declaration. This will only involve completing a short form. What’s more – one single Gift Aid declaration can apply to all past donations you have made (since April 2000) and to all future donations you make.

As a higher rate taxpayer looking to reclaim tax from your donation, all you have to do is remember to include details of your charitable gifts on your tax form. Also, from April 2003, higher rate taxpayers were able to reclaim tax relief from donations paid to charity both during the previous tax year and during the current tax year, that means the relief is paid that much quicker.

Donors who are liable to tax at the basic rate

If a donor wishes to make a regular net contribution of say £100 to the Chaplaincy, this is paid from their gross income of £128.21, on which they have to pay income tax. At a 22% basic rate of tax they pay £28.21 in tax, leaving £100 to be paid to the Chaplaincy. The Chaplaincy can then recover tax at the basic rate from the Inland Revenue and the gift is worth more to the Chaplaincy than one that does not qualify for tax relief.

Donors who are liable to tax at the higher rate

Donors who are liable to tax at the higher rate (40%) will have paid £51.28 in tax. The Chaplaincy can re-cover tax only at the basic rate but the higher rate relief can be claimed back by the donor – by entering the details on their Self Assessment tax return. A net gift of £100 to the Chaplaincy then only costs the donor £76.93. The Chaplaincy will hope that this reclaimed tax will be used to increase the donation at no extra cost.

Do you qualify?

Providing you pay as much tax (income and/or capital gains) as the Chaplaincy will be entitled to reclaim on your donations in the same financial year, you are entitled to use Gift Aid. For example, if you wish to Gift Aid your charitable donations that total £100 in one year, you will need to have paid at least £28 in to the taxman in respect of that tax year.

Share Giving

Giving shares to the Chaplaincy is not a new idea, but since April 2000, there is a new tax incentive to make Share Giving even more attractive. Individuals who give shares to charity are entitled to claim back full tax relief against the value of those shares. So, a gift of shares worth £1,000 will only cost a higher rate taxpayer £600, or £780 for lower rate taxpayers and furthermore, no capital gains tax will apply.

There are many reasons why giving shares might appeal to you. You might hold windfall shares as a result of a privatisation or demutualisation that are effectively gathering dust, making little difference to you, but they could make a big difference to a charity. Or, you may own small parcels of shares, perhaps as a result of an inheritance that you regard as a bit of a nuisance as they generate more paperwork than income. These could be turned into something of real value to others by donating these shares to charity.

How does it work?

Tax relief is available to UK taxpayers donating shares and securities listed on the UK Stock Market, the Alternative Investment Market, and recognised stock exchanges overseas. It is also available for units in a UK unit trust, shares in a UK open-ended investment company (OEIC), and some similar foreign investments.

You can claim tax relief equal to the market value of the shares on the day you make the gift, together with any associated costs such as brokers’ fees. Furthermore, capital gains tax (CGT) on any increase in the value of the shares since you bought them, will not apply. However, if your shares have gone down in value, you should be aware that you will not be able to use this loss to offset any other CGT liability you may have.

For complete information see the Inland Revenue web site

Downloadable forms

Click on the links below to download and complete the relevant form.

Please remember to include a bankers order form with either of the declarations

| Gift Aid Pledge & Declaration | Gift Aid Declaration |

Donations

Tax efficient giving for Spanish tax payers

Click here to download the Spanish tax payers form

As a Spanish tax payer I am sure that you would want to know that there is a way for you to increase the value of your gifts to the Chaplaincy.

For some time UK tax payers have been able to take advantage of the “Gift Aid” scheme, which enables the Church to recover the tax paid by them on their planned gifts.

Now the Spanish government, through the Agencia Tributaria, has allowed us to apply a similar scheme for those of us who pay tax in Spain. It operates differently, but with the co-operation of donors who pay tax in Spain, the advantages are just as great.

Under this new arrangement you can reclaim tax at the end of each year on the value of gifts made to the Chaplaincy as a part of your annual tax return. You can, therefore, increase your weekly or monthly gifts as you wish.

Giving can be way of a Standing Order or by using the existing envelope scheme.

And under this new scheme there is the further advantage that additional gifts, whether regular, occasional, or even one-off, can take advantage of the tax rebate. This makes it a flexible and generous way to benefit the Chaplaincy at no additional cost to yourself.

If you pay tax in Spain – I would encourage you to sign up for this scheme as this is the most advantageous way for your gifts to be worth more to the Chaplaincy.

A form for the Spanish tax scheme is attached and I would be very happy to discuss this new scheme with you. Naturally any discussion would be in strictest confidence.

With every good wish,

Dennis Johnson

Alicante

Spain

E-mail; tresoroblanca@gmail.com

Telephone 686 499 060